Harnessing Insurance Analytics to Navigate Market Turbulence

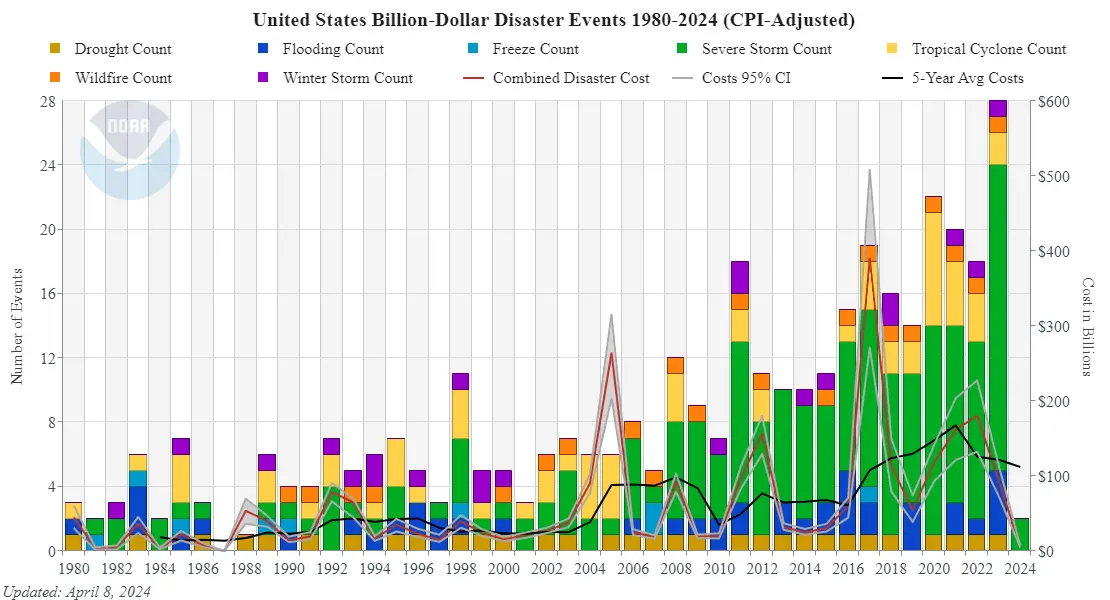

The insurance market is experiencing significant shifts due to extreme weather events, changing regulations, and economic dynamics. Several large insurance carriers are sharply reducing their writings in certain territories and/or completely pulling out of markets to preempt catastrophic financial loss. This sends a signal to other competing carriers that danger lies ahead, and they are considering similar actions.

How can insurance companies successfully retain existing business and acquire new customers in this climate? This blog explores how carriers are using analytics in CRM to adapt and thrive under these conditions.

Market Dynamics Impacting Insurance Carriers

States like California and Florida are witnessing the brunt of insurance changes due to the increased frequency of wildfires and other extreme weather events. Litigation and regulation are forcing insurance carriers to reconsider writing business in jurisdictions like these where liability on claims settlements can’t be reasonably predicted and where judgements can exceed multiples of what carriers would be willing to pay.

At the same time, external dynamics such as consumer inflation and mortgage interest rates are impacting the housing market across the country. This is having a negative impact on the construction industry, home builders, renovators, durable goods manufacturing, and industries both directly and indirectly connected to the housing market—including the insurance industry.

The Role of Insurance Analytics in Mitigating Consumer Impact

Insurance consumers impacted by regulations and weather events are facing an availability crisis. Where insurance is available, rates are often much higher than consumers are accustomed to paying, and in some cases, business insurance does not offer the full scope of what is needed.

This leaves insurance agents scrambling to find placement for private consumers and businesses in large and growing segments of the insurance marketplace. It also poses a threat to renewals, as agents are put in the difficult position of finding placement for their renewal clients under severe time constraints.

Analytics can help insurance providers manage and mitigate the effects on consumers, ensuring that rates remain fair and coverage is adequate. In the following sections, we’ll explain how.

Transforming Challenges into Opportunities with CRM and Analytics

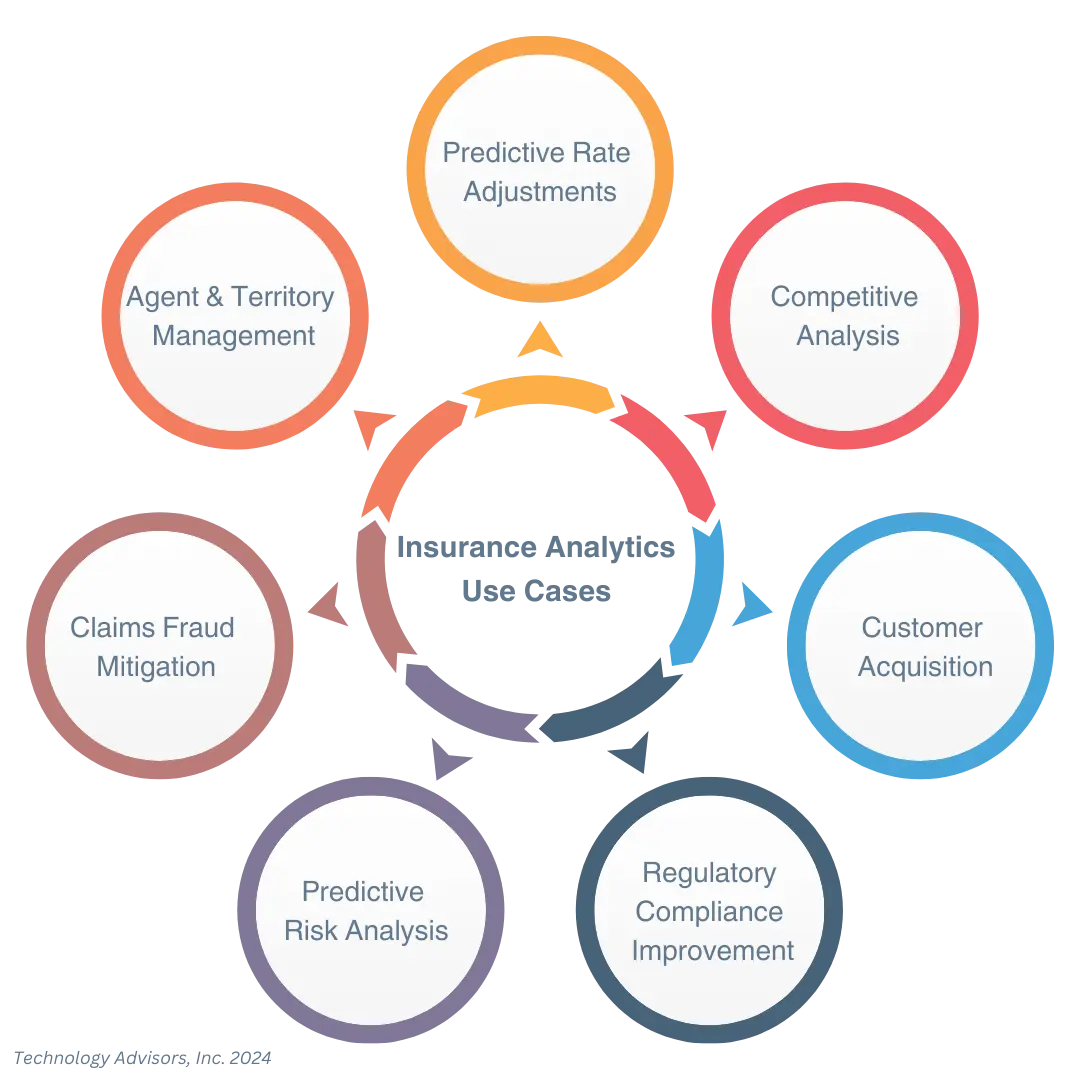

The core of proactive customer management lies in effectively utilizing Customer Relationship Management (CRM) systems powered by advanced analytics. Insurance carriers can leverage CRM to assess impacts on their renewal portfolios, maintain competitive positioning, and enhance agent performance amidst market changes. Insurance analytics use cases include:

- Predictive Rate Adjustments: How will a 10% increase in rates affect the renewal portfolio?

- Competitive Analysis: What is our competitive stance against top market players?

- Agent and Territory Management: Which agents and territories are least affected and should we strategically target for growth?

- Customer Acquisition: How can we better facilitate customer acquisition strategies based on behaviors?

- Claims Fraud Mitigation: How can we apply predictive models enhance our fraud detection and reduce annual loses?

- Predictive Risk Analysis: In which areas can we predict risk to allow underwriters to focus more on complex, judgment-based decisions?

- Regulatory Compliance Improvement: How much could we save by effectively managing regulations, detecting issues quickly, and streamlining reporting to avoid penalties and protect our reputation?

Case Study: Ringler’s Succes with CRM Analytics

Tapping into previously unknown customer insights is helping insurance agencies break through the obstacles of the current market. Take, for instance, Ringler, the largest and oldest settlement planning company in the United States. Ringler works with insurance professionals and their clients to manage structured settlements.

Their team of 150 consultants is spread across 70 offices throughout the country, making accurate analytics critical for their long-term growth.

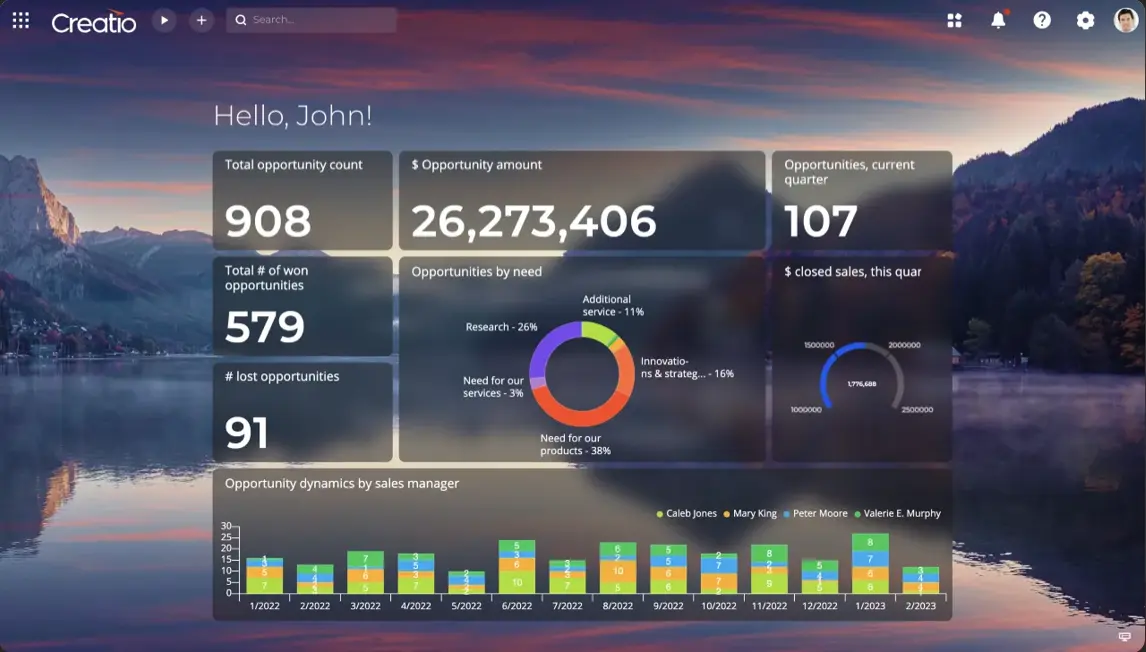

Ringler partnered with Technology Advisors to implement no-code CRM leader, Creatio, to consolidate their applications under one umbrella while driving growth and innovation. Technology Advisors guided Ringler’s Creatio project, helping them create custom processes and automated workflows to support their operations.

Creatio analytics allowed Ringler to proactively calculate best-fitting products for their customers and run a business process to estimate commissions for the sales teams. Security features manage access rights between offices and clients to ensure privacy is always top priority during this process.

Shared reports and dashboards inside the CRM make key data available to leadership so they can monitor sales and marketing outcomes and track common trends.

Acting on Analytics